Dundalk FM Interview with Marissa Lucchesi

Irish Freedom Party candidate Cathal Ó Murchú and Albert D Byrne who is running on an independent ticket and John McGahon of Fine Gael on this mornings Town Talk with Marissa Lucchesi.

Download FREE abridged version of personal autobiography ‘Amazing Grace’ published under the Pen Name Lee Albert

Download here:

https://www.albertbyrne.ie/Amazing Grace by Lee Albert aka Albert Byrne Abridged.pdf

A Review by David Botsford on Amazon

Amazing Grace, by Lee Albert, skilfully combines a factual account of ibogaine, a mind-altering natural substance found in Africa, with insights into spirituality and personal development, reflections on a changing Irish culture and heart-felt autobiography.

The author describes, movingly and powerfully, the experience of growing up in a small town in the Irish Republic at a time when its people and institutions were dominated by the Roman Catholic Church. After two years’ training for the priesthood, the author turned from his own religious faith and embarked on a geographical and spiritual odyssey that culminated in an inner transformation through eboga, the ceremony in which the user consumes the powerful Afrcan sacramental plant eboga, which is mainly used in the western world (as ibogaine) for helping people overcome heroin addiction. It has been banned for personal use in several countries, including the United States, although, as Albert demonstrates, it is in no way a recreational Substance and has quite astounding healing properties.

In this first-ever popular book about ibogaine, Albert combines Solid factual information about the eboga experience with personal Reminiscences about how it enabled him to experience an inner transformation, healing psychic wounds and enabling an appreciation of the spiritual world and a newly integrated connection with reality which he compares to the quest for the Holy Grail in the Arthurian legends.

Amazing Grace is a unique and substantial book in the Tradition of Carlos Castaneda, and is sure to fascinate and enlighten readers interested in personal development, the nature of spirituality, the therapeutic and transformative use of mind-altering substances, and Irish culture and identity. I highly recommend it to all such readers.

David Botsford, Clinical Hypnotherapist.

Letter to the Editor: Drugs & Gang Crime

A Chara,

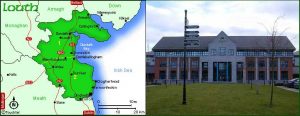

I am standing for election to the Dáil in the constituency of Louth and would like to share some thoughts in relation to drugs and gang violence with your readers:

We will not fix the problem until we know the solution and for that we need to think outside the box. As Einstein once said: the definition of insanity is doing something the same way while expecting a different result.

In Portugal, where drug use was decriminalised in 2001 (if the user had no more than a 10 day supply) there was a fear that there would be more drug users and with that more crime. The opposite happened. In addition, sexually transmitted diseases and deaths due to drug use decreased dramatically. There has also been a 60% increase in uptake of treatment programs as of 2012. The tax payer has benefited from the decrease in costs of incarceration and the war on drugs. Money which can be better used elsewhere.

Social exclusion is an important factor in the seduction of crime as is a lack of education and emotional development. When I lived in Peckham, London in the late 80’s I was struck by the sense of disaffection felt by many who lived there. There was a strong sense of detachment from the mainstream and crime was simply a way to survive. Taking from those perceived to have access to what they needed did not pose a moral dilemma. The rules of normal life did not apply and as such were not taken seriously.

So the solution has to be multi-factorial starting with funding for preschool education to give children the strongest possible chance for success in life, i.e., emotional intelligence is equally if not more important than what we normally refer to as intelligence and this begins in the creche. When government cuts back on investment in education, outreach programs and community policing and fail to fund much needed community projects, a rise in gang crime is inevitable as is the misuse of drugs. We need to recognise the needs of vulnerable youth who feel ostracised and are easily seduced by the camaraderie of criminality.

The causes of gang violence are deeply rooted and will not be solved through reactionary measures but by cool collected reasoning and public funding which eventually is clawed back by the benefits a reduction in crime brings.

That is why we must always be aware of the needs of the under-privileged in our society and seek to instil a sense of belonging for everyone in our community.

It is also worth mentioning that many of the social problems we now see are a result of the bank bailouts and the economic crash of 2008, not to mention the siphoning off of state funds through badly managed infrastructure projects. This has led to suicides, domestic violence, drug abuse and so on. We need a system which does not allow government to waste tax payers money and pass on the social problems which ensue. For this we need reform and transparency.

Is mise le meas,

Albert Byrne

Candidate Louth Dáil Election 2020

Facebook: www.facebook.com/albertdbyrne

Web: www.albertbyrne.ie

LMFM Candidate Interview 22 May 2019

Local Election debate for the Ardee Electoral Area with Finnan McCoy Fine Gael, Fintan Malone Fianna Fáil, Kevin Carroll Independent & Albert Byrne also an Independent candidate live in studio.

Gepostet von LMFM am Mittwoch, 22. Mai 2019

Letter to Local Papers May 15th 2019 – Ardee By-Pass

A Chara,

Re: Ardee By-Pass

Progress which undermines social cohesion and cultural practises (not to mention local business) is not the kind of progress that addresses our social problems. We are all concerned with rising crime but social disharmony is a leading contributor. That is why I want to take a moment to explain to your readers why the present plans for the Ardee By-Pass need to be amended in a cost neutral but all-inclusive way.

As things stand the new bypass will result in a cul de sac on the Ardee side of the Churchtown Road with 2-way access via a ghost island on the Churchtown side while another cul de sac will appear on the bog road with 2-way access on the Ardee side via a ghost island for Ardee Precast Cement. We have many examples of ghost islands on the road to Carrickmacross where traffic is queded before turning off. Further on down where the new road crosses the Silverhill road, access will be on both sides. What local residents are asking for is a roundabout on the Churchtown road which will, as it stands, be level with the new road and an underpass on the bog road which will, as it stands, be below the new road and therefore an optimal solution. The cost for both these changes may in fact be less than the original plan with no further CPO required. The residents have proven this by taken the land area of the roundabout on the Ardee Carrickmacross road and showing that it in fact fits very easily into the current land purchase. A roundabout is the safest junction in the world.

If we are in agreement that the changes are cost neutral or indeed less costly than the current plan then let us examine what will happen if these changes are not implemented.

At present a school bus collects children on the Churchtown Road to bring them into Ardee. With the present plan they will be required to cross the new road to be collected on the opposite side. (A similar situation exists on the bog road.) This poses a health and safety risk. Every road death in Ireland costs the state 2.5 Million euro not to mention the social impact it brings. A roundabout will allow the bus to continue to pick up children while mimising risk to life. At present there are 1,200 road trips daily on the Churchtown road and another 800 on the bog road. An estimated 2,500 people will be affected including people who drive to Ardee every morning to take public transport to work. Clearly this will introduce extra hardship on an already stressful situation and that can only have a socially negative impact.

If none of the above matters then consider the economic cost. It is estimated that between the affected rural population of 2.5K residents and Ardee Coach Trim an annual 3.6M euros is fed into the local economy. How much of that will be lost if the more convenient location for shopping is Carrickmacross or Kingscourt?

I remember as a boy the joy of participating in the local 5 mile walk for charity along these roads and as an adult I sometimes enjoy the privilege of riding my bicycle down memory lane. Indeed my own mother walked these roads. This route is something very special and unique and is an important part of our heritage. Are we now seriously considering needlessly cutting off routes which have served and defined our community from time immemorial while denying ourselves and others the pleasures that they bring? Is this the way to build our tourism and social infrastructure? Is this the way to preserve the best of our traditions?

At present there is a section of the population which uses these quieter roads to go about their daily business at a pace that in these days is rare to find. The present plan will bring unnecessary stress into their lives. Is that how we serve all sections of our community?

If none of the above troubles you then please consider this. There are now 20 nesting curlews that have returned to the river Glybe area. With the rerouting of traffic onto the Silverhill road which is in appalling condition, as access will be cut off on the bog road, this endangered species will be subject to noise pollution for which they are supposedly protected under EU regulations. Eventually the road will have to be repaired regardless. What will that cost?

So one has to ask how wise are our planning regulations if by placing a straitjacket on a given project, despite the wisdom and economics of change, we are undermining our community, our tourism and our business. This is how social unrest grows.

Having spoken to the infrastructure department in Louth County Council I am reliably informed that Transport Infrastructure Ireland would look favourably on a second scheme to introduce these changes. However that does not make sense. If that is the case then the changes should be brought in now at less expense and less disruption. By the time a supplemental scheme has materialised (if at all) the impact could be hugely detrimental. However, this does show that there are no health and safety reasons not to make the changes and that therefore we are all agreed in principal they should go ahead.

I understand people are rightly scared the project may be put on hold. As it stands the work is due to start in September proper and I am assured by the senior engineer it’s a very robust scheme. There is plenty of time to resolve this at little or no risk. Let’s not repeat the planning mistakes of the past and undermine our heritage in the process. Let’s stand together and do the right thing for Ardee, for ourselves and for the surrounding communities.

Is mise le meas,

Albert Byrne

Independent Candidate for Mid-Louth

Letter to Local Papers 12 May 2019

A Chara,

I am running as an independent in Mid-Louth on a platform of reform and transparency and would like the opportunity to address your readers.

I am passionate about reform of local government and reform of Justice and Policing. These are fundamental to a just and fair society. In addition I am committed to the success of the Ardee bypass in a way that is socially inclusive along with the revival of tourism in Ardee centred around the castle and the incentivisation of business in our town centers. I also believe Louth County Council should declare a climate emergency. If elected I will stand for one term only. That is a promise I intend to keep.

According to a recent survey by Transparency International Louth County Council scored 12 out of 30 on a national integrity index covering transparency, accountability and ethics (source: www.transparency.ie/local-authority/report/louth-county-council). In the area of planning permission out of a total of 3 questions it scored zero.

Meanwhile Earnst & Young rated Ireland the most globalised economy in the world while the world trade forum ranked Ireland second to Belgium. This means Ireland depends heavily on foreign capital and unless its institutions are fit for purpose will suffer financial shock if there is an international crises. Democratic institutions clearly play an important role in the financial security of the nation as the bailout of the banks testified. We must do all that we can to ensure we do not have a repeat of the last financial fiasco where financial institutions collapsed and government acted to bail them out without a proper mandate from the people.

We must therefore make our institutions fit for purpose at all levels to ensure full transparency and proper accountability. We must also safeguard our human rights.

If elected, as part of this process, I will seek to implement the recommendations of Transparency International which will include, as my first order of business, bringing forward a motion that will require Louth County Council to publish on its website:

a. A searchable database of past and current planning applications, with complete documentation for each application.

b. Written submissions and observations submitted by the public on county development plans along with all written motions made by County Councillors.

In regard to local businesses, despite a return to boom times in our capital we still see empty shops and underdeveloped areas in rural towns. Town centers are the heart and soul of our community and should be fostered along with any future out of town development. Peripheral development which overlooks corresponding town center development is detrimental to the social fabric of our community. Shops which are empty contribute nothing to the budget. Financial incentives should therefore be put in place such as relief on rates and reduced taxes to encourage small traders to develop their businesses in underdeveloped areas. We need to look to tourism and services to fill the gap left behind by more traditional enterprises. If Dublin city center can be regenerated through tax concessions then why not underdeveloped rural towns if a need clearly exists?

We have to take a holistic approach to the overall development of the community to ensure social cohesion. We need to build new relationships with tour operators as well as organise walking tours that exploit our much undervalued heritage. In that respect Ardee castle can become a visitor center around which a revival of tourism in the area can take place.

I am someone who believes: act locally and change globally. So, for those who are appalled by the state of the world at home and abroad please use your democratic mandate on the 24th May and vote for change and help create a better society, one which can show leadership in a world badly in need of change.

Is mise le meas,

Albert Byrne

Sunday Business Post 18th Oct 2009

Drowning in a Financial Storm

Sunday Business Post (Full Text) 18th October 2009

A Chara,

Like a ship in stormy seas our banking system almost capsized. Now the government wants to hoist the sails once again regardless of the prevailing conditions. Even garbage can grow green shoots.

It appears that stating the obvious that NAMA is cash for trash or the socialization of losses and the privatization of gains is criminal or even that NAMA is unconstitutional, has little effect on a government that daily fills the airwaves with creative nonsense & poetic license to confuse the public in response to every serious criticism of its plans.

It is clear from the lowering of the amount of debt to be transferred to NAMA, due to fear of public outrage no doubt, the banks have a lot more hanging in the balance. They will not restructure loans as to do so means to acknowledge the full extent of their losses and lessen their claim in the unlikely event of an upswing. Given that the government is there to bail them out what incentive do they have to create a healthy banking sheet? The problem is left to fester with exposed highly leveraged loans and an oncoming wind of negative equity and mortgage defaults waiting for a second NAMA. The government is content to leave a sick and irresponsible banking system at the heart of Irish business while pretending NAMA will make a profit, rather than admit the billions tax payers will more than likely have to pay. How appallingly unrepresented we are. The mentality that created the problem worsens it.

The recent boom was fueled by access to easy credit from economies such as China which led to an explosion in lending and an inflated house price bubble fueling a false economy which benefited large developers and bankers. Since the crash Irish savings rates have jumped from 3% in 2007 to 10% in 2009. Combine this with a drop off in easy credit, a doubling of personal debt in the last 5 years, a serious decline in house prices and rising unemployment, the reality is property prices will decline even closer to their true value and the economy will stay in recession. In a 13th September 2009 interview Joseph Stiglitz, two times Nobel prizewinner for economics said: “In the U.S. and many other countries, the too-big-to-fail banks have become even bigger,” “The problems are worse than they were in 2007 before the crisis.”

It’s absurd to suggest the market has bottomed and prices are going to recover when the conditions for such a recovery are fundamentally flawed. “The stimulus that we have still got to give the world economy is greater than the stimulus we have already had,” Brown told reporters in London before his departure for the Group of 20 meeting in Pittsburgh in September. “What we want to do is safeguard a recovery from a recession we feared would develop into a depression.” Yet pressure is on governments to restrain spending due to rising national debt. The same phenomena occurred during the great depression leading to a double dip. We are by no means out of the woods. The present financial shock may just be a splash in the oncoming tsunami that may hit this economy. With the loosening of banking practices in recent years more and more U.S. banks are in a sick state and likely to fail. Lehman’s only represented a fraction of the debt risk in the financial markets. However, instead of preparing by becoming airtight, we are recreating the perfect storm. Our banking sector will be as open as a raft on the high seas. We may very well find ourselves under the stewardship of the IMF as ECB borrowing will be exhausted.

Whatever solution we employ we must ensure that we do not make the problem worse. The banks must be cleaned up, start lending and be transparent to prevent a repeat situation and to restore confidence in the financial markets which are forward looking. Nama achieves none of these objectives. Our post-Nama banks will be fighting for survival while struggling to contain significant losses arising as a consequence of Ireland’s ongoing economic deterioration. Lending to SME’s will decline as they represent a higher risk during a recession. Given the ECB’s base rate is currently 1% while its 10 year projected average is 3.8% repossessions are clearly set to rise.

The credit agency Moody’s has stated NAMA will not improve the credit ratings of Irish banks to borrow. How can it, when it effectively props up a sick banking sector hiding the true extent of their dysfunction with the help of the government? At the same time doubling national debt in an economically illiterate way sends a message to the financial markets that Ireland is unable to manage its debt.

Contrary to the governments assertions neither the ECB nor the IMF support NAMA. The ECB has stated: the government should not pay more than the actual value of the assets and has warned against the danger of banks using the monies they are paid to rebuild their equity rather than lend to new and existing customers. The IMF on the other hand have stated: insolvent institutions (with insufficient cash flows) should be closed, merged, or temporarily placed in public ownership until private sector solutions can be developed.

We need to look at further risks to the banking sector given the fragile state of the global economy and recognize that the financial crisis is not yet over. Yet Nama encourages the banks to return to their old ways and leaves the problem festering while passing on the losses to the taxpayers whom the banks will have no choice but to evict from their homes once it is politically able to do so. The government by that stage will be in the life boats while the rest of us are in the water drowning.

Is mise le meas,

Albert Byrne

Ardee, Co. Louth

Madam President – Nama is Unconstitutional

Madam President – Nama is Unconstitutional

26th September 2009

Madam President,

I would like to draw your attention to the NAMA legislation and why I believe it is repugnant to the constitution and as such, under article 15.4 of the constitution, should be referred to the Supreme Court to test its constitutionality.

According to a report by Davy Research (July 2009) net government debt stood at €41.8bn year ending 2008 (excluding €3bn to recapitalise Anglo Irish). It anticipates a total of €19bn will be required to recapitalise the banks. Of this €14.7bn is expected to come from the state with the remainder coming from the banks themselves. The minister of finance estimates NAMA will cost €54bn where the book loan value is €68bn + €9bn of unpaid interest, i.e., €77bn. Recapitalisation of the banks & NAMA will therefore add a further €68.7bn (which includes €2.7bn risk share) to government debt. Of the €77bn in loans, €28 billion are held by Anglo Irish Bank who classifies just 11% of its loan book as business banking (Fintan O’Toole, Irish Times).

Davy research argues that net debt will be less given NAMA’s asset values. However, if the real value of NAMA’s assets are closer to those assigned to the Zoe Group in the recent High Court action (approximately 25%), it is difficult to see how any developer would be able to continue making payments on property whose real value is significantly less than the outstanding debt – in some cases a 10th of the original valuation. A conservative estimate by Richard Curran, Sunday Business Post, places NAMA’s portfolio at 45% of its peak value based on worldwide property valuations, i.e., €39.2bn of an €88.3bn total using a LTV of 77%, making default &/or special discounts for borrowers a more likely prospect. The minister Brian Lenihan stated on the Pat Kenny Frontline show that the banks would be paid less if valuations were less. However this is incompatible with keeping the banks solvent without more costly state funding, which the government has stated it will do if necessary and all the signs are it will be necessary. In addition, the Construction Industry Federation chairman Tom Parlon has stated that the additional €5bn the government is to make available to complete projects is not nearly enough.

If the government does decide to hold onto these assets to recoup its losses, rather than subsidise developers by way of fire sale auctions or otherwise, an average interest payment of 4.2% will have to be paid to the ECB over the next 10 years, as pointed out by Richard Bruton, based on the projected average 10 year ECB base rate of 3.8% where the government is liable for 0.5% above this, i.e., a potential total of €32bn. In addition, Justice Frank Clarke in his judgement against Zoe Group stated there is considerable downside risk to property prices for the next 2 years. Given, for example, that Dundalk has sufficient zoned land to last until 2073 NAMA values will fall even further as land is rezoned to agricultural use. According to Morgan Kelly, economist UCD, Ireland’s property bubble is remarkably similar to Japan’s where, almost 20 years later, prices are still 50% below peak levels. The government’s assertion that the market is bottoming out and showing signs of recovery based on higher property yields is flawed as rents are being propped up by legislation and eventually those yields could fall to zero as businesses go bust (David Fitzsimons, CEO Retail Excellence Ireland). As stated by Ronan Lyons, Irish Times: “It is scarcely credible that Nama’s entire estimation of long-term value hinges on rents, despite evidence to the contrary, holding constant in a subset of the total loan book – a segment that accounts for perhaps 5 per cent of the loan book in total.” Chief economist Alan McQuaid in Bloxham’s third quarter Irish Economic Overview said the property market will only stabilise when the labour market does and warns of thousands of further job losses before the middle of next year. He believes the fall will continue for some time yet (The Post). Presumably, this will affect NAMA’s development project loan values aside from landbanks & associated loans (mainly commercial properties), the other 2 segments of NAMA’s loan book.

If the government does not make deals with developers we are left with Catch-22. Either the state sells off the assets at a huge loss to the tax payer or else they hang on to the properties in the hope, however speculative or unlikely, that values will recover whilst huge amounts of interest are paid. It seems inevitable further borrowing will be required even allowing for 40% of loans which are “performing.” Additionally, the so called risk share of €2.7bn to be paid if NAMA turns a profit is a double edged sword. If NAMA does not turn a profit this implies the banks will also be in trouble and may require further bailing out. In all of this no account is being made of the assets which have been used to secure the original loans, many of which are based on overvalued property and secondary bank loans. Neither does it take into account the enormous running costs which will be incurred by NAMA. The fact that NAMA is already beginning to resemble the tribunals in terms of consultancy costs (€2K+/day) does not bode well for its future (Daniel McConnell, Sunday Independent). Further, the proposed levy on banks (which may be a drop in the ocean) in the event of significant loses may be difficult to impose as banks could also be in trouble and will resist any attack on their funds pointing, for example, to any special arrangements made by NAMA as a cause of lost revenue and therefore not of their doing. Meanwhile the Supreme Court has expressed concern that the Zoe Groups’s continuous appeals, which now run into November when NAMA will be in place, are seriously affecting the courts resources and an appeal has been made against Zoe Group by ACC Group on the grounds that it is abusing the legal system (Irish Times).

The ECB has stated that the government should not pay more than the actual value of the assets and has warned against the danger of banks using the monies they are paid to rebuild their equity rather than lend to new and existing customers. At the same time the IMF has stated that secret entities (which NAMA is) have less chance of success. A lack of transparency is at the heart of Ireland’s political problems and could be costing the economy up to €3bn per annum in lost revenue and foreign investment due to political influence that stems from political funding that is unlawful (Transparency International Report 2009). Such influence, no doubt, is not unrelated to the non-transparency which contributed to the collapse of Anglo Irish.

The question the people are asking is: why are we not following due process and implementing a strategy that protects the tax payer’s while managing government debt, instead of passing secret & complex legislation designed to use tax payer’s money to cover private investor’s losses? The reality is: billions of euros spent on NAMA & recapitalising the banks will go straight into the pockets of investors & borrowers who by due process are entitled to very little. Before NAMA officials were silenced they spoke of their concerns at its complexity and their lack of experience. Department of Finance officials have said that the NAMA scheme will be among the most complex plans ever introduced by government (Irish Times).

Sweden exited its banking crisis by following due process: shareholders paid first. As the former conservative Swedish finance minister Bo Lundgren pointed out on Good Morning Ireland, Sept. 3rd, the Irish economy is strong on the baseline and private investors will return once recovery begins. Many other strategies exist to protect the taxpayer which the government have resolutely rejected & ignored from day one insisting that NAMA was the only way forward. One solution put forward by Dermot Desmond suggests supporting the banks to resolve their own problems via guarantees. He states: “Nama as conceived will do untold long-term damage to Ireland Inc. It will result in paralysis for decades to come.”

There is the assumption that banks will start lending once bailed out. Anyone following the problems in the UK knows this is simply not true. Governments around the world have used public money to bail out banks only to see many of them quickly return to profit and resume setting aside billions for bonuses (Bloomberg). In relation to bonuses Lord Turner, head of the FSA (UK), said: in many cases the banking industry was socially useless (The Guardian Weekly). In addition, according to Jon Ihle, The Tribune, the banks are bracing themselves for significant post-Nama losses arising as a consequence of Ireland’s ongoing economic deterioration. Thus, the priority of banks will be their own survival and building up their balance sheets via careful investment. Given that Irish banks are also under intense pressure by overseas investors to repay loans, as their reputation is impaired, lending into the economy is a long way off. In addition, the credit agency Moody’s has stated that NAMA will not improve the credit ratings of Irish banks to borrow (Bloomberg). Yet the government has made no arrangements whatsoever to ensure lending takes place. It argues that it has directors on the boards. However, the recapitalisation package only gives it 25% of the voting rights and the government has also stated it does not intend to take control of AIB or BOI.

I firmly believe NAMA is a form of social & economic suicide and defies common sense. It is a continuance of the same economic mindset where it has not been uncommon for state run projects to have cost overruns of the order of 4 with all liability passed on to the tax payer (Dr Sean Barratt, TCD). It comes at a time when the McCarthy report suggests €1m can be saved by closing 350 Garda stations while the original estimate for NAMA & recapitalization is €68.7 thousand million, a large portion of which is going to a bank with very little connection to the real economy. It is myopic to say the least & symbolises all that has been wrong with Ireland’s economic & political system. It replaces natural economic transformation by costly, inefficient, entrenched stagnation where problems are postponed and not solved. Given the enormous impact this will have on the provision of social services for generations, at a time when government is implementing cuts on the most vulnerable in our society for a small fraction of the sums involved, the question has to be asked: who or what does NAMA serve?

Instead of promoting a healthy, accountable, banking system, NAMA props up the old irresponsible culture via the creation of complex and expensive quangos while maintaining an unaccountable banking system which is inherently sick and vulnerable to disaster at the heart of Irish business. Even ardent free marketeers recognize why the markets kill off such entities. Martin Wolf, chief economics commentator at The Financial Times, says regulation of major financial institutions will fail repeatedly as regulators are not well paid and not very motivated and that financial regulation should be similar to the regulation of utilities.

By mortgaging the state to the hilt, the country is also being placed in a perilous position. Should the economy deteriorate further we will be left financially naked having fired all our shots. We may be compelled to borrow vast sums of money for years to come and ultimately may not be able to borrow at all, forcing us to turn to the IMF for help. NAMA is therefore, apart from anything else, an avoidable but clear and present threat to our sovereignty and as such is repugnant to the constitution.

Madam President, 80% of the people have no confidence in this government nor the incoherent arguments being used to bedazzle them long enough to get NAMA enacted – an oasis the Zoe group are clinging to dear life to reach. Yet, the people are powerless to act. Article 45.2.iv of the constitution states: “That in what pertains to the control of credit the constant and predominant aim shall be the welfare of the people as a whole.” Yet NAMA will squander public funds on a small sector of society while a mortgage timebomb is in the making as interest rates rise, house prices fall, the economy worsens and the government’s 12 month mortgage guarantee comes to an end. After all the billions of untaxed earnings in the hands of a few while social problems grew, must the ordinary tax payer now pay a Celtic Tiger tax and deliver the final blow to the ideal of a just society? If we are to stand by article 45.1 that states: “justice and charity shall inform all the institutions of the national life,” then I humbly suggest Madam President this bill must be referred to the Supreme Court in order to test its constitutionality.

Is mise le meas,

Albert Byrne

www.albertbyrne.ie